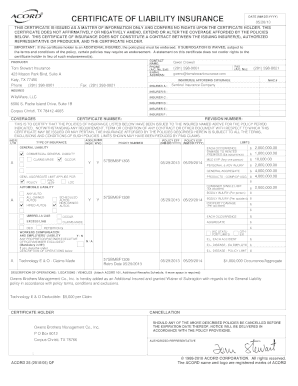

MT MCS 32-J 2013-2025 free printable template

Get, Create, Make and Sign MT MCS 32-J

How to edit MT MCS 32-J online

MT MCS 32-J Form Versions

How to fill out MT MCS 32-J

How to fill out MT MCS 32-J

Who needs MT MCS 32-J?

Video instructions and help with filling out and completing mt mcs j pdf

Instructions and Help about MT MCS 32-J

Welcome to our video on What Business Licenses are Needed in Montana presented by StartingYourBusinesscom This video is a part of a series of video son starting a business in Montana Starting a business in Montana may require licenses or permits from a variety of several city county state and federal agencies This video is a brief overview of the most common licenses permits and registrations a business may need, but it may not include all ones needed for your business More detailed information and links to allow the agencies mentioned in this video are on StartingYourBusinesscom The first registration you may need to get the employer identification number sometimes known as an EIN with the Internal RevenueService This is a unique identification number for a business much like what a social security number is for a person business that are required to register include sole proprietorship with employees partnerships corporations or LCS If you are a sole proprietorship with no employees you can simply use your social security number You can apply directly at iron and therein no cost to get the number Getting the number takes only about 5 minute sand if you have questions we have a video on how to apply for an EIN on our site Next there is no general state business license in Montana, but there are some industries that are required to register A variety of businesses and professions in the state are regulated such as food establishments barbers cosmetologists message therapist sand many more To find links to all of these visit StartingYourBusinesscomAlso if you are self-employed or have employees you will need to pay payroll taxes More information is at the Montana Department of Revenue Last at the local level some municipalities may require a business license or have requirements for certain professions zoning construction signage liquor licenses etc Make sure your business secures all license sin advance of finalizing a location as some will take some time to get approval Finding the correct person to talk with in your community may take a few calls but just start by contacting your towns mayor city hall or economic developer and let them know you plan on starting a business and if you need to register Don't be worried in calling as they want to help bring in new businesses since businesses bring jobs and tax revenue to the community For more information on how to get a business license for your business in Montana check out Startingyourbusinesscom If you liked this video on What Business Licenses are Needed in Montana be sure to watch the others in the starting a business in Montana series Starting a business can be difficult, but you don't have to do it on your own The StartingYourBusinesscom site has lots of information to help get your business started, and we have experienced business advisors ready to answer your questions at no cost

People Also Ask about

Do I need a DOT number in Montana?

What is MCS in Montana?

What is the phone number for the road report in Montana?

What is the phone number for Montana oversize permits?

What is the MCS Patrol Montana?

What is the phone number for Montana MCS Patrol?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify MT MCS 32-J without leaving Google Drive?

How do I execute MT MCS 32-J online?

How do I edit MT MCS 32-J straight from my smartphone?

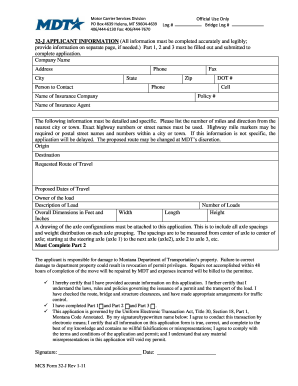

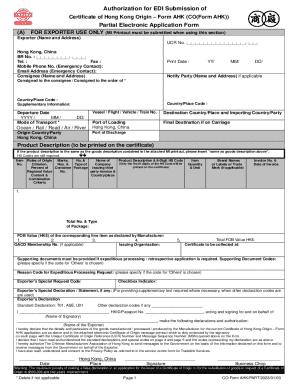

What is MT MCS 32-J?

Who is required to file MT MCS 32-J?

How to fill out MT MCS 32-J?

What is the purpose of MT MCS 32-J?

What information must be reported on MT MCS 32-J?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.